New ways for buyers to change the playing field

Most recent efforts to scale customer acquisition campaigns revolve around a basic formula: Test. Spend. (Hope and Pray for results). Wait for Results. Repeat. And these efforts also operate on a timetable where adapting and adjusting to the marketplace happens on cycles that can take as long as 2 weeks, a month or even a quarter.

Today, we live in real-time and consume on-demand. And in real-time, technology affords the chance to solve many of the issues or performance and scale — simultaneously. This means you get to pick both!

For mortgage providers, buying through an exchange like the PX platform is a new and different way to acquire customers efficiently. With multiple sources, swaths of data, and real-time analytic tools available, it provides a proving ground for scaling customer acquisition programs.

It creates new advantages that were not there before, with the opportunity to drive down your cost per funded loan.

Two Major Challenges to Scale

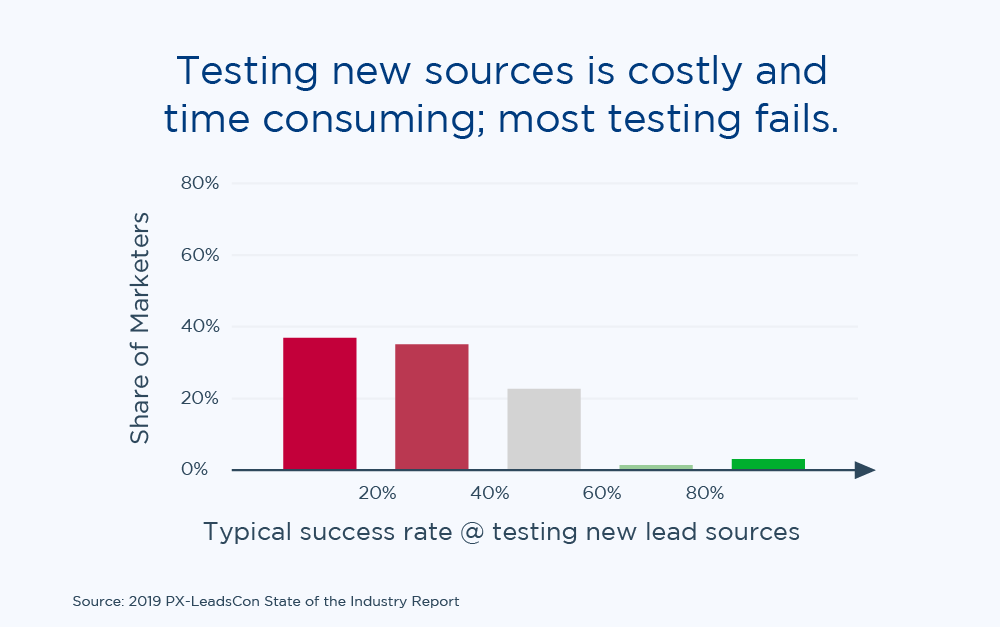

A consistent challenge we see — specifically for mortgage providers — is that with each attempt to scale a program, performance drops. It seems that every step forward (to add additional sources or opportunities) is met with a large step back (by finding that these new sources are inefficient). It creates a vicious cycle that gets you nowhere.

The second challenge to scaling is the ability to efficiently test in new regions or new arenas. In most any endeavor, going outside your comfort zone can be a recipe for inefficiency and/or failure, driven by a lack of confidence, information, or experience.

The Solution

The core solution to both of the above challenges is an execution model that requires speed — and much more modification than an old school lead buying program will allow. The speed is required to quickly deploy pricing and payout adjustments based on initial results. The increase in modifications come from testing many different sources in many different ways. Slicing the pie on a constant basis, so to speak.

It is a model that can only be adopted when buying through an exchange, and it involves 3 basic elements:

1. Dynamic Pricing

Purchasing leads through an exchange — like PX — enables marketers and buyers to adjust what they spend for each individual lead in real-time. When doing so, all of the factors that can affect the performance of leads and the likelihood of leads to convert can be continually parsed and filtered. This enables effective bidding with the right price nearly every time.

Think of the many factors that can determine the quality of leads. Day of week; time of day; traffic type. These are the simple ones. Then consider demographics and geography. Loan amounts. Think of layering in Jornaya Intelligence data points. Then consider that you can create multi-layered pricing and targeting strategies based on whatever combination you choose — and enable it to be executed and optimized to build scale — at your desired cost. Click here to learn more about Dynamic Lead Pricing!

2. Source Management

As noted earlier, finding new, effective sources can be an arduous and often fruitless task for most buyers. However, an exchange such as PX affords buyers a wide variety of sources to choose from. And they are pre-integrated to the platform, without the challenges of finding, vetting, contracting and integrating each one into your LMS or CRM.

Each of these sources can be quickly tested and ultimately deployed on demand, in a manner that focuses on its strengths, prices its leads dynamically, and creates a stronger plan with more sources and less risk in each one. Learn more about PX Source Management.

3. Reviews and Adjustments

Every plan that aims to scale must include checkpoints to review and adjust. The faster that a plan can course-correct based on real data, the more quickly it can scale at a desired cost-per-funded loan. PX provides real-time reporting on performance, so buyers are never more than a screen away from seeing the performance of their campaigns — and just a click away from taking action to improve it.

Specific to mortgage leads, it’s inefficient to wait for conversion data, since it can take 45 or more days to complete a funded loan. In the absence of end-of-funnel conversion rates, PX programs are optimized toward early stages of the sales funnel: credit pull, application, or origination rates.

Best Practices to Scale Your Campaigns

Using the above approach, the PX platform creates best practices for mortgage providers to scale their campaigns. With a goal toward volume and performance being possible, our Client Success team follows this approach and these practices to get there:

1. Set target CPAs prior to launching a new campaign.

2. Establish a benchmark to proactively measure performance.

3. Identify your key metrics including early indicators like: Contact, Credit pull, Application, Underwriting, and Funded Loan.

4. Analyze. Optimize. Modify. Thoughtfully analyze and make optimizations and make pricing modifications if needed

In the end, this approach mitigates risk by enabling buyers to quickly develop and execute measured tests. It also enables them to find the best sources, pricing, and process to find their customers, not just more leads.